|

|

Black Swan Investing

| |

This is Sooty's approach to an investment strategy that depends on the kind of catastrophes that

erupt in financial markets every five to ten years. Any such approach needs to span at least

one catastrophic event so we are talking about a very long (ten year) planning horizon. This is

not of interest to day traders. Since there are many markets you don't have to hibernate for

five years waiting for the next cycle in your favourite market. You could instead take the time

to learn about international markets and other kinds of markets while you wait.

Sooty is a deep value, income focused investor so that biases the way investments are made. The

advice will be to look for bargains and let the stock buy you out with dividends or distributions

so you never have to sell them. There are other ways to play these catastrophic events and this

article will suggest a few other investment strategies that could be used by short sellers or

technical investors.

The approach is based on a narrow interpretation of the kind of events described in The Black Swan by Nassim Taleb.

The book covers a great deal more and offers a generalized description of Black Swan events. Sooty recommends

you read the book to understand what Taleb means by the term and accept this article only as "Sooty's Black Swan events".

Most important Sooty does not trade on Black Swans - he agrees with Taleb that these are unpredictable - but after such

an event Sooty suggests the markets are not efficient and there are predictable swings in price that offer opportunities

for arbitrage.

Before getting to Black Swans we need to talk about luck and decisions.

Good Luck, Bad Luck, Good and Bad Decisions

Let's talk about lotteries. Most lotteries return about 35% of the ticket sales in prizes. Some lotteries like your

small local community 50/50 draw returns 50% but the big money is in the big lotteries with multimillion dollar prizes.

If you invest $1000 in lottery tickets you expect (statistically) to get $250 to $450 return from your winning tickets.

Good luck should then be defined as getting more than $500 and bad luck would be winning less than $200. Winning

a $5 million grand prize would be very good luck indeed but with a vanishingly small probability and we only interested

in likely outcomes.

Let's say your $1800 rent is due at the end of the month but you only have $1000 so you are short $800. You choose to

invest the $1000 in lottery tickets (hoping I suppose for $5 million). Your expected return is $350 but you have good

luck and win $600. Even though you had good luck it was a bad decision because now you are short $1200. This is the

"good luck - bad decision" path.

Suppose your boss pays you $1200 every two weeks on a Friday but you have the bad luck that you next payday is the 5th.

You landlord will have your belongings in the street by the 2nd and no reasonable institution will lend you money. So you

go to a payday loan company who gives you $1000 for your pay check. So you pay your rent and even have a little left over for beer.

This is the "bad luck - good decision" path. Not a great outcome but at least you have a roof over your head.

Black Swan Events and VaR

There are some events that are so highly improbable that no one expects them to happen. Some events are negative (like

being hit by lightning) while others are positive (like having a distant relative include us in their will). The insurance industry is

built on making us aware of negative events and selling us contracts to cover any damage. Scam artists rely on making

their victims believe they are the beneficiaries of improbably positive events (yes the Nigerian government really has a

million dollars sitting in an account with your name on it).

The financial industry has to deal with risky choices all the time and there is a standard way to calculate these risks.

These are based on an estimate of the insurance premium you should be willing to pay to cover your loss in a risky

event. Let's say you have something worth $1000 that has a 1% chance of being destroyed in a year. You could create an

insurance pool by paying $10/year into the pool. If there were a thousand other people with the same risk contributing

to the pool we would have $10,000 (1000 x $10) going into the pool every year. At a 1% chance there would be ten people

that would need a payout every year and that would consume the $10,000 (10 x $1000) so the pool covers the risk. Of course

a bigger pool would reduce the chance a single "bad luck" year would break the bank this is why insurance companies have

to be large to work.

It turns out that a proper VaR (Value at Risk) calculation has to consider that there is probability distribution (usually Bell or Poisson)

and it must have safety margins to ensure we do not exhaust the insurance pool in a "bad luck" year. For financial

instruments you also have to include the mathematical complexities of efforts to reduce your risk (like stop loss orders

or credit swaps) but the idea is the same.

The basis for VaR and insurance calculations is that the "value at risk" is fixed and rare events (way out on the distant tails of the

probability curve) have a probability so close to zero you can safely ignore them. In a Black Swan event this assumption

is wrong.

In the 2008 crash the calculation was done on each financial object in isolation. The problem was the objects were linked

through a variety of structures and contractual clauses. The objects did not fail in isolation. When one failed it triggered

events in other objects which caused them to fail and the chain reaction was never considered in either the governance of

the financial institution or the calculations used to price the objects and their insurance. The cascade lead to a complete

collapse of the network of financial institutions holding these linked objects. The crash is an example of a negative

outcome Black Swan.

Let's go back to our lottery because it can never have a Black Swan event. Let's say it is a 649 lottery with a prize of $5 million.

You could buy tickets on every possible number (a lot more than $5 million) but never win more than $5 million because the value

of the object is fixed.

Instead of putting a $100 in lottery tickets you are J.K Rolling and spend the money on pens, paper and

postage to create a fantasy novel. The odds are a 100 to 1 that you will every get published. You are one of the lucky ones and

you do get published. The Black Swan event is beyond luck because your novel finds a special place in the hearts of millions

of readers and it turns you into a billionaire. Of course there are the other 99 that did not get published and if they also

put $100 into their efforts the total pool would be $10,000...from which there was a $billion prize. The improbable event

is completely out of proportion to the value of the pool. This is what makes it a positive outcome Black Swan.

Investing in Black Swans

In other pages on this website Sooty asserts that all stocks go to zero. For the Dutch East India Company it took just over 200 years, for

General Motors is was about a 100, for some pump and dump mining stocks it is a few months. History is unambiguous: if you hold a stock long enough it loses

all of its value.

Sooty also asserts all markets develop value bubbles that cause crashes (Joseph Stiglitz who got the Noble in 2001 says the same thing).

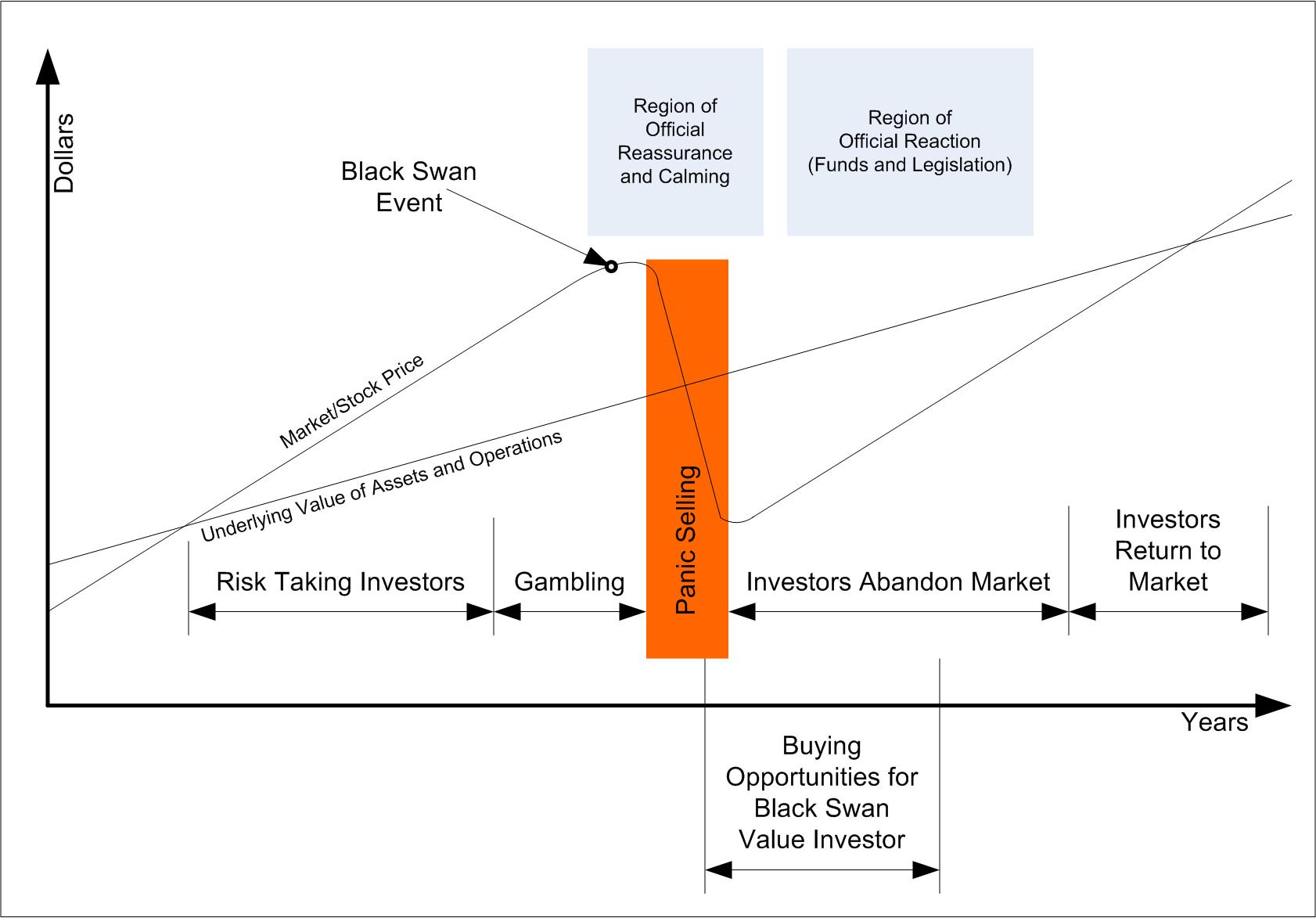

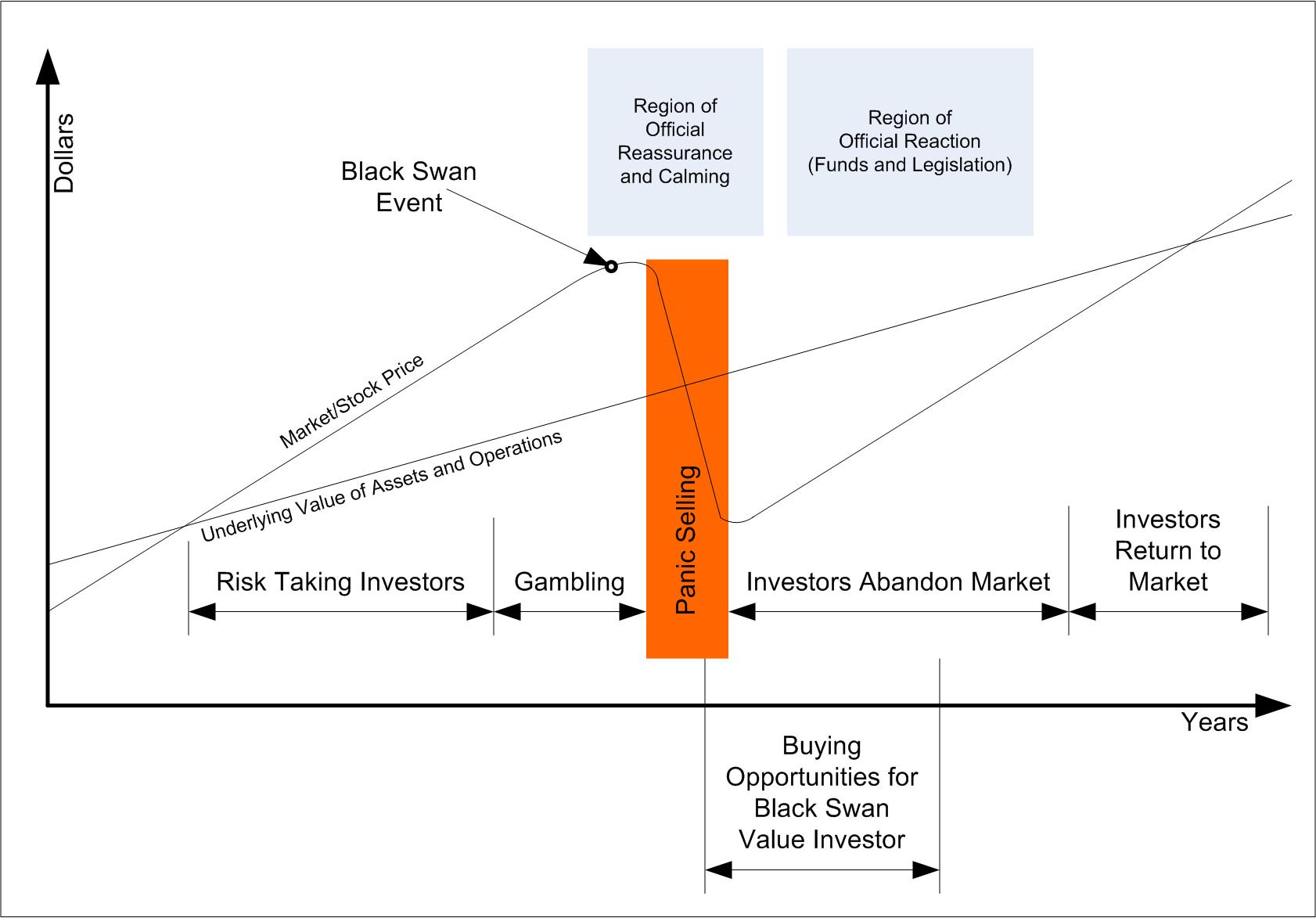

Sooty suggests markets grow and collapse in a sawtooth pattern. Immediately after a crash investors are extremely conservative and the

economy surrounding the market grows faster than the market index. As the memory of the crash fades investors become more willing to

take risks and because the market index is lagging its economic foundation their gamble is rewarded "in excess" of the risk taken.

As the growth phase continues the investors compete for riskier investments and the market index begins to lead the economy.

That overhang (bubble) grows until some inconsequential event (such as a Black Swan) causes a chain reaction which exposes the fact that the

index is too optimistic. The "rush to exit" the market causes a rapid collapse that overshoots where the index should be (mathematically)

and sets up headroom for the next expansion of the index.

Well you say, "that's quiet a story Sooty." It is a very simple explanation for market cycles and like all simple explanations of complex phenomenon it is bogus.

While the explanation is bogus it does carry a few truths:

- Investors just before a crash are very willing to take on unreasonable risk and more important they are unwilling to critically assess the risk

they are taking. Unfortunately this increase in risky behavior is often not visible until after the crash so it is a poor predictor.

- The "rush to exit" overshoots the proper value of the index. This means at the bottom of the market a deep value investor has a lot of

bargains to choose from (if they have any cash).

- Investors are extremely risk adverse for an extended period following the crash. This period lasts for at least several months and may last

several years. There is no need for the value investor to rush into market to pick up bargains. Those bargains will be around for a long time

and there is lots of time to do a thorough analysis on candidates and make sure they will actually survive the economic shock from the

market crash (not all companies will).

- In the period just after the crash the market index is too low. This means a patient investor will see early good growth in their choices

and need not get a refill on their tranquillizer prescription.

- Several years later there may come a time when the price of the bargain stocks has grown to be uncomfortably high. Sooty is a buy and hold

investor and would be extremely hesitant to sell at this point. Sooty only buys income stocks so it is highly likely that the income stream has reduced

his adjusted cost base (ACB) to zero so a crash in the market will not affect his investment...but it never hurts to have extra cash after the crash so maybe it

is a good time to sell a few grossly overpriced stocks even if the absolute peak is missed.

Alternative Black Swan Investing

Short sellers can do well during a Black Swan crash but they have to have incredible patience. It is nearly impossible to predict the crash so like

fishing all you can do is bait the hook and wait. The strategy is to write shorts as if the crash was going to happen the next day.

Market volatility will mean some of the shorts will pay off and you will probably break even except for the transaction fees.

Five to eight years of break even shorts will accumulate a lot of transactions fees. You will lose money in every month for years while you wait for that

catastrophic event. There will be a moment of glee when the world collapses and you make a lot of money but soon you will be back to losing a little

each month. Taleb mentions someone who used this strategy and had four very large pay days. He also suggests the strategy took a toll on the poor

man's health. He suspected that no matter how much you believed in the strategy your lizard brain will only understand you had failed

every month and the stress will show in your body.

Sooty does not believe in technical charting and suspects that moving averages, supports levels and trading patterns are more likely to hide the

fact that the market is about to collapse than expose it. There is however the possibility that a measure of oversold (price/earnings, price/cash flow,

enterprise/book value) could be plotted that should rise to a peak just before the crash. Sooty is looking for data to try to create a technical

model but the free historical data only has closing price and volume. This is not enough to build a compete model. A quant like Taleb probably had

access to more complete data sets and may have had enough to build a crash predictor or at least an "oversold barometer". If he did no one was paying

attention to it during the 2008 crash. I suspect it is more likely no effective version of such a computer model exists. Fertile ground for you

technical charters to pursue.

If you could predict the crash with some accuracy you could sell all your equities just before the crash and sell an bunch of shorts. After the cash you

could take all your cash and start looking for bargains. This would give you the market timer's gains on the rapid high to low and the longer low to high. It would

also give you the leverage of an options trader on the way down. It would be like getting three (chart, short, bargain) pay days in a row and it about as likely

as wining three different state lotteries on the same day.

Looking for Black Swans

By definition a Black Swan is totally unexpected and rare so it is extremely unlikely that an average investor would see the Black Swan that caused a crash.

What they will see is the rush to the exit as first the insiders then the common folk decide that the economic world is coming to an end.

Take some time and read the news reports of the 2008 market crash as it happened. Do not read the 2010 book on the subject because it will almost certainly

reinterpret history to make the whole thing appear more understandable and rational. A market crash is a chaotic and irrational event. Do not believe anyone

who has an after-the-fact soothing story that suggests otherwise. In fact go back to June 2007 and read the press coverage of the Bear Stearns collapse.

This will sensitize you on how unexpected the crash was. It also may sensitize you to the kinds of assurances made by senior managers

and politicians that things are under control. When you hear those assurances in the future it should give you a gut feeling that a storm is coming.

Now the bad news - you probably missed this crash. During 2009 the market index probably caught up to the "economic value" of the stocks. There

will be growth as the market value starts to overhang the economy but it will not be the same as buying bargains in 2008 Q4 or 2009 Q1. Go find yourself some

good income stocks build some cash reserves and watch for signs of the 2015 crash. Sooty is doing exactly that and is also looking into market bubbles in

other national economies and specialized markets. If he finds something it will show up as an update at the bottom of this page.

Updates

November 2009: Sooty believes there will be a crash in the US Dollar and describes the process here.

Sooty is not predicting a Black Swan event (Taleb would be angry) but what he is predicting is that there will be some trivial event that will cause a

cascading rip through the currency markets that is all out of proportion to the original event. Sooty does not predict what the triggering event will be or

when it will be. He only suggests there are growing bubble conditions that make the USD crash more likely and advises you keep your cash ready to

swoop in after the crash to pick up bargains from panicked sellers.

|