|

|

Impending Crash of the US Dollar (November 2009 Update)

| |

If this is your first time at sooty.ca you may want to back up and read the introduction

on investing in US stocks (NYSE, NASDAQ) found here.

The Short Version of the Prediction for Twitter Users

In the near future (24 months) the growing stresses on the US Dollar will result in a currency run

and collapse to 60% of its 2008 value.

There is a Why, How, When, and What Can You Do About It in the following text but it is safe to say the news is

not all bad for the average American but it could be very bad for foreign investors (like Sooty) if

they get caught when the currency bubble bursts.

Why the US Dollar is Under Pressure

The "why" is headlined almost every day in the news. . .but it looks like things are getting better so most people

are ignoring the problem. The truth is the US economy is in a very bad state and the financial collapse

in 2008 was just the first in a series of bad things that are about over the next 24 months. While to

rest of the world (lead by China followed solidly by the rest of the BRIC and Europe) will return to pre-crash

growth rates in 2010 but the repeated pounding of the US economy will keep it firmly stuck in a 2008 time trap.

When the residential subprime mortgage bubble burst those holding the mortgages quickly discovered they had more

debt than assets. Normally this would result in a bankruptcy with the stock holders losing everything and the

bond holders losing a bunch but taking over the corpse. There were two things that made the situation so bad the

governments had to intervene:

- The big mortgage holders bought insurance policies called "default swaps" which meant when

their mortgages tanked the other side of the insurance policy had to cover the loss (a reasonable precaution).

However the other side had not understood the risks properly (they were lied to by the credit rating agencies like

D&B) so they under priced the premiums and did not build reserves large enough to cover the losses. When the insurance

companies failed all their other insurance policies became invalid and the cascade nearly caused the entire

insurance market to fail.

- The crappy mortgages were mixed into portfolios of mortgages to diversify the risk. This is normally a good idea

but these portfolios became an entity in themselves called a mortgage backed securities which were divided up

into shares. These shares were "derived assets" that were then sold as if they were real assets which could be

packaged with other assets to create new portfolios. With each level of packaging and resale the leverage increased

as the amount of real asset became a smaller and smaller part of the derived asset.

The reason the government had to step in was that the packaging, repackaging and swap insurance was so wide spread that

no one knew where the bad assets were. There was a deep suspicion that all the mortgage backed securities

were junk and everyone was holding worthless paper with no backing insurance. If this suspicion was allowed to turn

into panic the resulting run would cause the complete collapse of the world financial network. This would have

made the 1929 crash look like spilt milk at a tea party. The crash we experienced was bad but the alternative

would have been apocalyptic.

The world governments may have looked a little disorganized throwing $billions at random targets but in fact most of

their actions hit the mark. The truth is that the subprime bubble was a one trillion (USD) hole that the world filled

with about two trillion dollars in bank buyouts and stimulus plans. Most of the world governments will get

their money back and quickly return to fiscal sanity. Britain will probably get half of its funds back but the US and

Iceland will have to take the full amount of the bailouts onto the government balance sheet. For Britain and Iceland

that was the end of the damage. For the USA there is another three $trillion more to go.

Three $Trillion More

There is about a trillion dollars in FIDC covered deposits for TSTS banks (Too Small To Save) that will be

failing over the next three years. When a TSTS bank fails the depositors accounts are covered against

loss up to $250,000 per customer per bank. So if you had a accounts of $200,000 in each of three different

failed banks your $600,000 would be safe. If a TSTS bank failed with no assets and $50 million

in insured deposits the new owners would get a check from the FDIC for $50 million drawn on the US Treasury.

That check is not backed by any real assets. The US government just "prints" $50 million to cover the check.

Why are the TSTS banks failing? They have failed mortgages on residential and commercial properties that were not

part of the derived assets shell game. In order to try to match the return rates of the big banks they used other

tricks to leverage these loans. When ordinary conservative house loans fail there is FHA insurance to cover the loss.

These losses are already so high that the FHA is running out of reserves and while it is a private entity it will

need government money to make sure it does not fail (one more government bail-out/take-over). TSTSs that

stuck to conservative residential mortgages will probably survive. They are like the Canadian banks. The TSTSs that

did more aggressive lending will have no loss insurance and no reserves (self-insurance) to cover the shortfall. It is

estimated there are over a thousand TSTS banks. . .so between FHA support on the way into bankruptcy and FDIC support

after bankruptcy there is about a $trillion needed to deal with the problem.

There is roughly another $trillion in failed mortgages. Didn't we cover that already? No we covered the mortgage holders and

we covered the holders of the derived financial instruments for the TBTF banks (Too Big To Fail). We still have a

problem: Joe Main Street bought a $400,000 house and did $150,000 of renovations because he could deduct the mortgage

interest against his taxes. Unfortunately he lost his job at the plant and now has no income so the deduction

is not much use. What he does have is a $550,000 mortgage on a house that now worth $300,000 and no way to make the payments

(some 23% of homes now have negative equity). For a look at the troubled US Consumer read this January 2009

Merrill Lynch USA Consumer in Trouble Report

To help Joe the government is going to have to take over his mortgage (think Freddie Mac or Fannie Mae)

and get his plant reopened. The subsidized mortgages will never pay much interest and with a USD decline the real buying

power of the mortgage asset will represent a large loss as a government investment. The closed plant

is probably uneconomic so that government investment (probably state and local dollars) will be a complete loss (think Crysler).

The last $trillion is from the fiscal imbalance. The economy has tanked and taxes collected are not covering the cost

of services provided at federal, state and local levels. These are not the previously mentioned support for failed

financial institutions or social spending on out of work Joes. These are businesses with reduced profits and

employees on short work weeks and no overtime pay. Governments are actually leveraged against their GDPs through

their tax systems so a small drop in GDP causes a big drop in tax revenue. Even though they have a drop in taxes

all levels of government will have to maintain their existing programs to keep the social fabric from falling

apart (Joe has a gun). Worse still they may have to provide additional services to deal with social

breakdowns their existing programs cannot cover (Joe used his gun).

How the US Government will Sink the US Dollar

The dilemma the US government faces is how to deal with the huge costs of digging themselves out of this hole.

Until now the choice has been to borrow the money. This covers the shortfall as long as there is someone

willing to make the loans. With China, Japan and Saudi Arabia each holding over a trillion USD in loans it turns

out America has some real solid friends. How much would your lend your neighbor? Even the best of friends have limits

and we are quickly approaching those limits.

A government has a capability most individuals do not. It can "make" money. They used to print money but the sums

are so large for an entity like the USA there are not enough printing presses on the planet to print the number

of standard denomination bank notes required. Zimbabwe tried to solve the problem by increasing the number off zeros

on their bills then doing a million to one reverse stock split when the numbers became silly. What the US will do

is less silly, less dramatic and more beneficial to Joe Main Street.

Remember double entry book keeping? You bought a truck so on the asset side of the balance sheet you showed the

truck as a new asset. On the liability side of the balance sheet you showed the loan for the truck as a new liability

and the book value on your balance sheet (assets minus liabilities) did not change. When you made a payment on the loan

you reduced the asset "cash" by the amount of the payment and also reduced the loan liability so again there was

no change in the book value.

What the US government has been doing in the past is proper double sided book keeping. They issue a check to buy

something (like AIG or GM bailout shares) or they cover depositors of a failed bank through the FDIC. This

reduces "cash" and they record the value of the asset on the government's balance sheet to keep the book

value unchanged. They sell Treasuries (to China, Japan or Saudi Arabia) to increase "cash" but this adds the loan

to the liability side so the balance sheet remains "balanced".

What the US government is starting to do is single sided book keeping. They issue a check to buy something but

do not reduce "cash". They record the asset and this increases the book value on the government balance sheet.

They also issue checks to buy back Treasuries that they sold in the past and this reduces the liability side

but this time they do not deduct the amount from "cash" so the book value on the government's balance sheet grows.

There are a number of code words used when these single sided transactions occur. You will see as reports of

quantitative easing or increasing the government balance sheet or

buying back government bonds. Whatever they are called it is still plain old "printing

money" and like a company printing stock certificates it dilutes the value of the US Dollar.

Detailed Mechanism for the US Dollar Collapse?

The explanation so far has been about economics but that has been all theoretical. Those pressures will not cause the

collapse. It will happen at a weak point. Like a balloon the whole surface does not fail. A tear starts at a defect

and spreads. The low interest rate is encouraging business actors in the US economy to make decisions that cause a

defect and the collapse will happen at that point.

People are losing homes and businesses in the US because they were heavily leveraged and depended on stable incomes

the keep the game going. When the income or paycheck stopped the downside of leverage was revealed. The US government

and Fed are now taking steps to save home and business ownership. The primary tool is a zero interest rate. In the short

term this is a good approach and it is working.

Banks are reissuing loans at very low rates because they can borrow cheap money. Some of these are long term some

are even 30 year mortgages. Sensible banks only lead their depositors money. More aggressive banks borrow short term money to

make these long term loans. Banks need to stay in business so they will keep issuing low interest loans as long as

the Fed keeps the rate at zero. As time passes a larger portion of their loan portfolios will be filled with long term low

interest loans.

The Feb cannot keep the rates at zero forever. The Japanese central bank has kept their rate at zero for ten years

but the structure of the Japanese economy is completely different and they could go another ten years before the Yen collapses.

When the Fed raises the rate (my guess starting in Spring 2011) it will be gradual. As the rate goes up the spread shrinks between the

low interest loans and the higher borrowing cost. Before long the aggressive bank is paying 6% for money to cover a 5% loan.

The sensible bank pays depositors 1% to cover their 5% loans so they're okay. Except the aggressive bank is now offering 4% on deposits

in an attempt to stay in business. The sensible bank finds its depositors are leaving to get the better rate and now they have to

borrow (become more levered) to cover their loans.

This is the small defect in the wall of the balloon. Pressure on the US dollar will cause it to drop a little, the inflation rate will

go up a little, and the Fed will increase their rate to compensate. The increasing rate will put more banks in peril until a cascade

of failures begins. The US Government will take over these banks and print money to insure the depositors are whole and the loans

are safe. News of the growing number of bank failures will put added pressure on the US dollar. When the short sellers smell blood

the whole thing collapses.

What Will It Look Like When the US Dollar will Collapse?

Nassim Taleb in the The Black Swan provides a very convincing argument that most significant events happen

suddenly and often unexpectedly. He was one of the authors of the mathematics used to evaluate derivative risk and

when he saw a problem with the math he predicted a crash and personally made a lot of money when it happened.

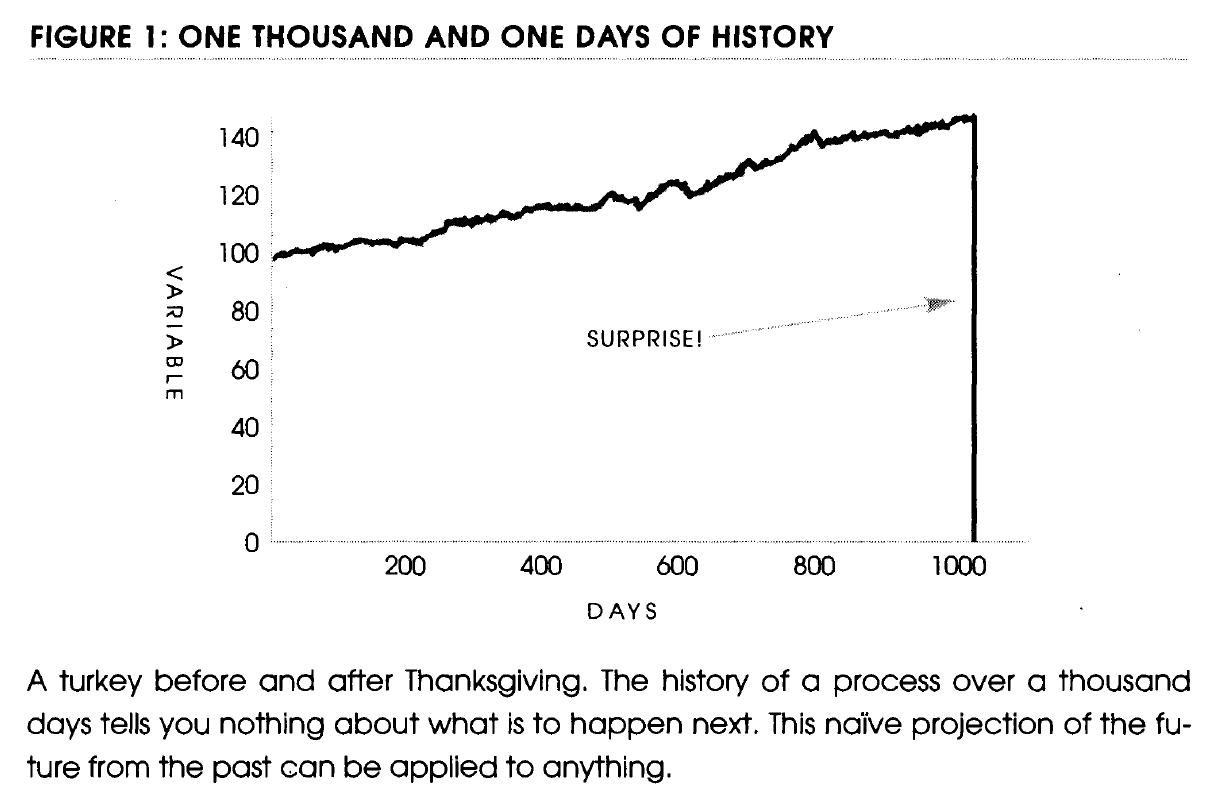

One of his key points is illustrated by a graph in the book:

The crash in the USD will have a similar pattern...everything will be okay until it is not. The pressure will

gradually build but the USD will remain solid then some random event or hedge fund bet will start a cascade

which will lead to panic and a run on the currency.

On a Friday afternoon the dollar will be worth a dollar. Early on the Monday morning the value will have

dropped 30% and appear to be in free fall (could be a Wednesday afternoon and Thursday morning - my crystal

ball needs cleaning). Hurried phone calls will result in a massive purchase of USDs by international banks and

by the end of the day the USD will only be down 20%.

Overnight phone calls and meetings will develop a defensive plan but the next morning the USD will have dropped

another 20% as panic sets in. Over the next week currency controls and an international effort will bring the

USD back to a 20% drop but the sell pressure on the USD will be enormous.

Over the following year the USD will be allowed to drop 30% at a "managed" rate. Many contracts written in USDs

will be rewritten in more stable currencies like the Euro or the Chinese Yuan. This will free more "transactional"

USDs that will flood the market and put more downward pressure on its value. Over the next couple of years the

drop will level out at 40% so the USD will have about 60% of its 2008 value.

So what Friday (or Wednesday) is that going to be? Take a look at the turkey graph. Thanksgiving is coming

but the turkey having no facility with calendars has no idea when it will be. We my friends are the turkeys

and I am telling you I can see cranberries being harvested so we will soon be cooked.

What Can You Do About a USD Collapse?

If you an American you can do two things: rejoice and re-elect Barack Obama.

I'll do the re-elect part first. The world likes Barack. The currency crisis is coming no matter who runs

the country but fallout for the average American critically depends on how the world reacts to a falling USD.

If the American government is disliked as much as the Bush administration the world will say "Screw you" and

everyone will devalue their currencies in lock step with the USD. The US economy will remain in desperate

shape but it will be compounded by massive inflation. It will be back to the 1930s. If Obama remains in

power the world will allow the USD to fall without any major retaliation. So on to the rejoice part.

Why rejoice? The falling USD will mean all foreign imports will become much more expensive; gold will go

to $1600, oil will go to $150, wheat will go to $500, and pretty much every USD based price will get multiplied

by 1.6 (so far so good no? Read on).

It also means a $30,000 imported Toyota will rise to $50,000 but the same model made in the San Antonio Texas plant

from US steel by US labor will still cost $30,000. Which one would you buy? More important those cheap Chinese

auto imports (don't kid yourself...they are coming) will have trouble competing with US made cars.

It means GE which has half its operations in foreign countries will bring home 60% more profits as those foreign

sales are converted to USDs. It also means they will pay much larger taxes. A Bush administration would cut the

tax rate to keep the tax take constant. An Obama administration will use the windfall to rebuild the broken

US balance sheet.

It means eco-friendly wind, water and solar power will be able to compete against imported oil. The resulting

technological advances will be built in the US and exported to the world.

This is a pretty rosy picture painted by Sooty who is a loyal Canadian. Actually since the USA is Canada's

largest trading partner what is good for the US is usually good for Canada. Just a friendly warning to my

American friends: don't do something stupid and fall in love with a strong USD. Your best bet is a weak USD

just ask the Chinese based on their experience with the Yuan over the last twenty years.

What Can an Investor Do About a USD Collapse?

Now you can go to the US Stocks page and read Sooty's investment

advice on non-US stocks on US exchanges. . . or go to Sooty's Black Swan Investing page to help

you find other catastrophic events to make money on.

The short story on US Stocks for Twitter users:

Don't hold USD assets or US stocks without foreign operations.

Do hold good foreign stocks on US exchanges, they will rise as the USD falls.

Post Script: The Downside If Sooty is Wrong About a USD Collapse

It is unlikely that Sooty is catastrophically wrong. That would mean the USD would rise against

other currencies. No one is predicting a rise in the USD. If you bought a bunch of non-US investments in 3 years

you are likely to show a rate of return that is comparable to the equivalent US companies. You might have even

done a little better if you bought BRIC companies because everyone is predicting a more rapid GDP growth in BRIC than

in the US economy.

If you want to measure this advice set up two play portfolios with US and non-US scenarios. Then you can

compare how today's "best choices" survive. Setting up the portfolios today will avoid the

Monday Morning Quarterback Syndrome when 3 years from now you feel like complaining "if I had bought

USA TofuBurgers in 2009 I'd be rich now".

|